Blog

Ann Arbor Medical Malpractice Law Blog

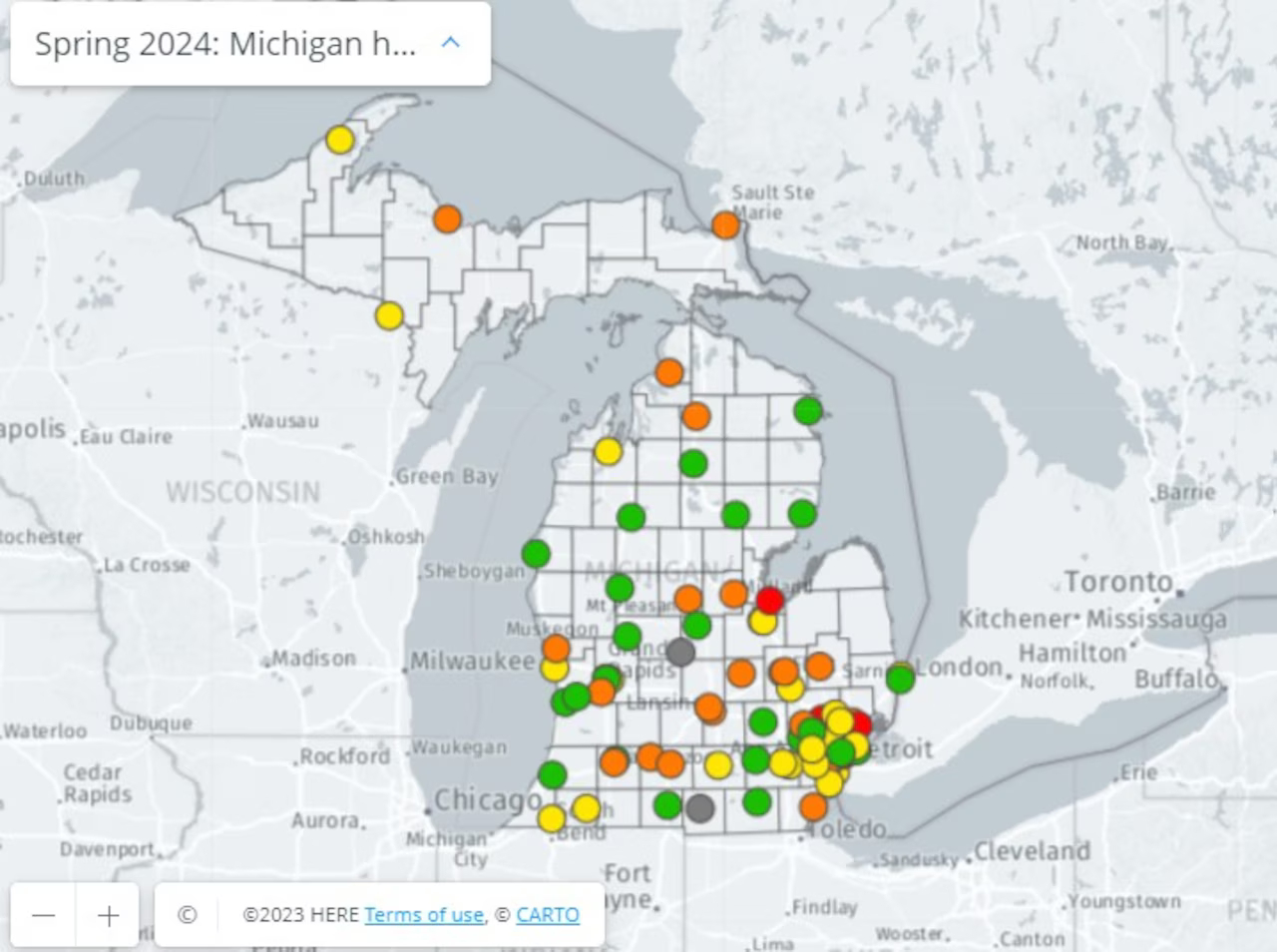

Safety Grades Declined for 16 Michigan Hospitals. How Did Yours Score?

Michigan’s spring 2024 hospital safety report card is here, with fewer “A” and “B” grades than the fall…

How Long Does a Medical Malpractice Lawsuit Take in Michigan?

Timing is often a pressing concern for individuals seeking justice and closure. The difficult answer is that they…

How to Find a Medical Malpractice Attorney in Michigan

A Michigan medical malpractice claim can be overwhelming during an already difficult time. Navigating the complexities of a…

How to Sue for Medical Malpractice in Michigan

When navigating a potential medical malpractice suit, there is a lot to understand about Michigan laws. An experienced…

Michigan Medical Malpractice Statistics

The history of Michigan’s medical malpractice cases is marked by legislative reforms and evolving trends in claims and…

Is It Hard to Win a Medical Malpractice Case in Michigan?

The consequences of medical malpractice can be devastating for a patient and their family. Healthcare providers are expected…

Average Birth Injury Settlement in Michigan

Birth injuries can have long-term effects on the mother, child, and family. When birth injuries are the result…

How Do I Sue a Hospital in Michigan for Medical Malpractice?

Hospitals have a duty to provide patients with the standard of care. Hospitals are responsible for the healthcare…

Can You Sue a Doctor for Malpractice in Michigan?

Michigan law allows patients who are the victims of medical malpractice to take legal action against their medical…

Birth Injuries in Michigan Hospitals

Childbirth should be an exciting time in the life of a family, but sometimes these occasions are marred…

When Can You Sue a Hospital in Michigan for Medical Malpractice?

Most people are familiar with the term “medical malpractice” but are not fully aware of the specifics of…

Michigan Medical Malpractice Caps

Medical malpractice is a highly complex area of personal injury law pertaining to claims for damages against medical…

How to Prove Medical Malpractice in Michigan?

Medical malpractice is a complex area of personal injury law that pertains to injuries caused by negligent medical…

Michigan Medical Malpractice Statute of Limitations – All You Need To Know

Medical malpractice is a term used to describe the failure of a medical professional to meet a patient’s…

What Constitutes Medical Malpractice in Michigan?

Most residents are familiar with the term “medical malpractice,” but there are many misconceptions surrounding this area of…

What Is the Average Medical Malpractice Settlement in Michigan?

Medical malpractice is a complex and commonly misunderstood area of law in the United States, and each state enforces…

Did a distracted driver injure you?

Common sense tells us to pay attention while driving but many careless drivers ignore that call. According to…

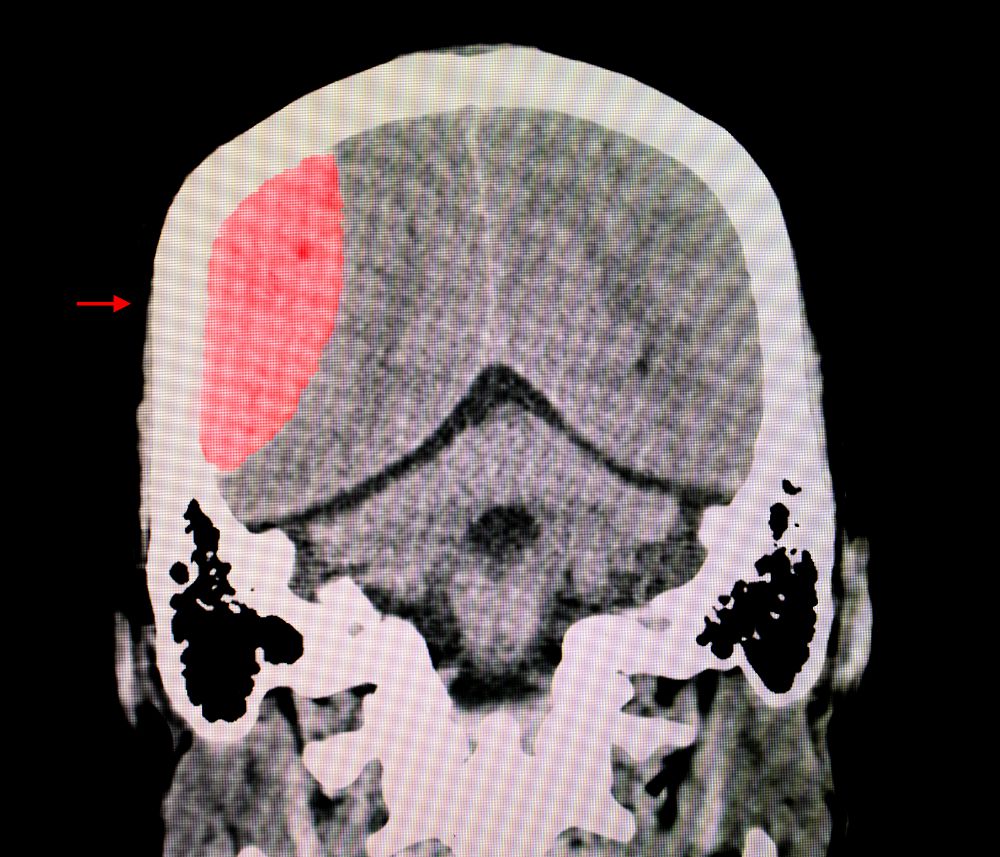

Your traumatic brain injury could be life-changing

On Behalf of Goethel Engelhardt, PLLC | Aug 6, 2021 | Catastrophic Injuries Suffering from a brain injury is life-altering in the short…

Yes, driving with children is dangerous. Here’s what you can do to help

Driving with children in your vehicle may be more distracting than you think. From crying to kicking the…

Should I avoid talking to the insurance company after a crash?

After a motor vehicle crash, you may wonder if your insurance company will be on your side. Although…

Goethel Engelhardt, PLLC

3049 Miller Road

Ann Arbor, MI 48103

Map